As we approach the halfway point of the decade, events of the past year underscore just how appropriate the name the “Roaring 20s” really is for the current era of media and entertainment. From dramatic advances in AI and ML technology and crumbling cookie-first ad strategies, to the rise of ad-supported channels and labor strikes across the industry, 2023 was truly a year of disruption to the status quo. Are these trends passing fads or seismic shifts? Read on for insights into how these trends will impact media and advertising in the coming years, and watch the full webinar here.

Sports content and the quest to overcome fragmentation

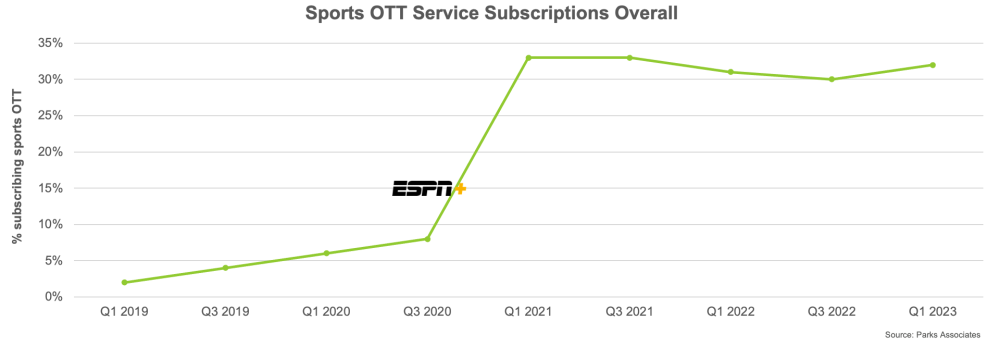

Sports rights have become a crucial factor in driving consumer interest and platform sign-ups. At the same time, fans continue to change how they find and consume content. With the rise of streaming services and social media platforms, we now have access to a vast array of sports content at our fingertips.

Highlights:

-

Sports streaming services expected to reach $22.6 billion in 2027

-

Consumer access to content now spread across multiple streaming services

-

Shifting reliance on regional sports networks

This abundance of choice has created a new challenge: discoverability.

Viewers currently navigate a deeply fragmented landscape of different platforms and services, each with its own exclusive content and user interface.

This challenge becomes particularly pronounced as the regional sports network (RSN) model undergoes forced adaptation in the face of shifting consumer preferences. Moreover, the financial dynamics of sports rights are undergoing scrutiny, with tier two platforms reassessing the viability of their investments in sports content.

So, how can sports platforms and traditional entertainment provide seamless discoverability and ensure that subscribers can easily find the sports content they want without navigating multiple platforms and user interfaces?

It requires:

-

Collaboration between different stakeholders, including rights holders, operators, content providers, and advertisers

-

Providing opportunities for compelling, customizable, and immersive viewing experiences

One way to do this is with FAST channels.

Life in the FAST channel lane

FAST (Free Ad-Supported Streaming TV) channels are a type of streaming service that offers free access to a wide range of content, supported by advertisements. Unlike traditional cable or satellite TV, FAST channels are delivered over the internet, allowing viewers to watch when and how they want. These new channels, such as World Rally Championship’s 24x7 channel for rally fans, can feature a mix of live and on-demand content, creating incredibly immersive and personalized viewing experiences.

In the past year, these channels have become increasingly popular thanks to their accessibility, convenience, and affordability. They offer viewers a way to access a wide range of content without subscription fees, making them an attractive option for cord-cutters and budget-conscious consumers. Additionally, the targeted advertising capabilities of streaming platforms allow advertisers to reach specific audiences more effectively, making FAST channels a critical advertising platform and revenue generator.

Yet, even though FAST channels represent a growing segment of the streaming market — and are expected to continue expanding — market saturation will pose an ongoing challenge. Personalizing the FAST channel experience will be crucial to maintain viewer engagement and drive higher CPMs.

Bundle up: Indirect wholesale SVOD to exceed stand-alone SVOD

Research shows that the average U.S. household has eight+ streaming services. Content may still be king, but the way viewers access it is certainly changing.

As aggregation increases, content wars are giving way to bundling wars, signifying yet another fundamental shift in how entertainment and media are consumed and accessed. Bundling models, where multiple services or channels are packaged together for a single subscription fee, have emerged as a powerful strategy for attracting consumers. Convenient and cost-effective, bundling will continue to capture viewers, especially as the landscape becomes increasingly fragmented and streaming services proliferate.

The shift of streaming wars to bundling wars means:

-

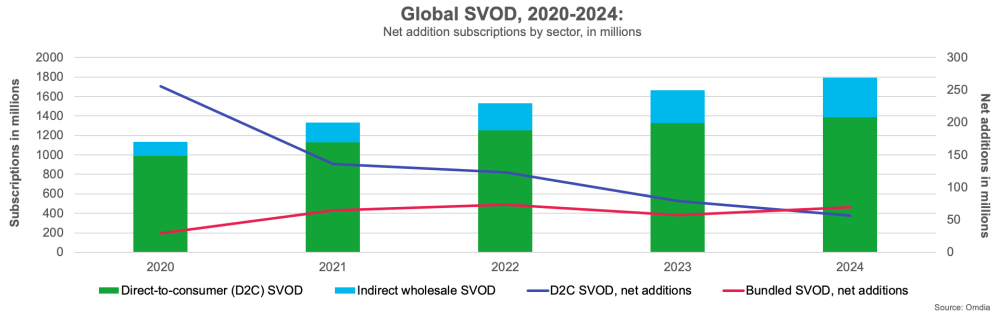

More subscription video on demand (SVOD) sign-ups will come from the bundled segment than from the direct-via-streamer segment.

-

Super aggregation bundles are emerging with operators and broadband, most notably in EU markets.

Stand-alone SVOD will still dominate, but by net additions, indirect wholesale SVOD subscriptions will, for the first time, exceed direct retail subscriptions.

Aggregators play a central role in these bundling wars, and those that effectively leverage data analytics to understand consumer preferences and behavior are better equipped to “own the customer” by curating tailored content suggestions for their individual users. By offering personalized recommendations, savvy aggregators enhance the value proposition of bundled services, helping consumers discover new content that aligns with their interests and preferences. This personalized approach not only improves the overall consumer experience but also increases engagement and retention rates within bundled ecosystems.

Ad revenue continues to rise. Advanced advertising strategies support success with streamers.

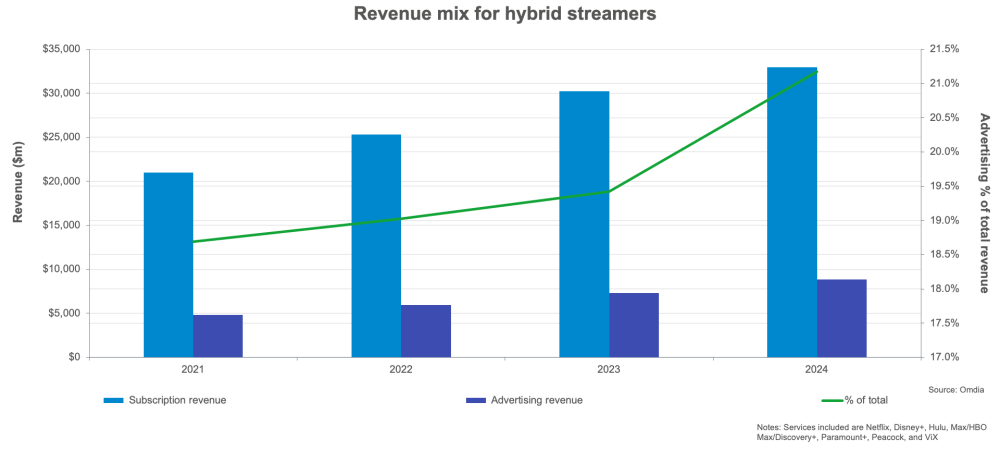

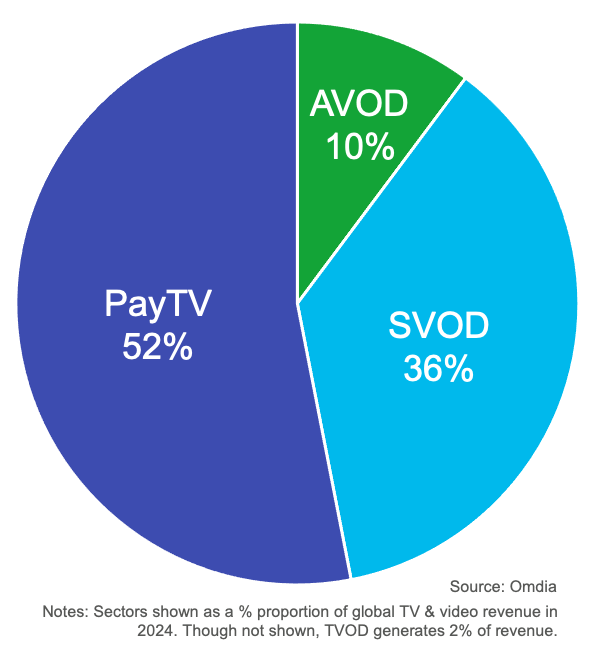

Advertising is expected to reach 21% of revenue for hybrid models. Our experts predict that services will strive to reach more than 50% of their revenue through advertising to match the traditional pay-TV model.

With this trend in mind, how can brands ensure they get the most out of their advertising efforts within advertising video on demand (AVOD)/hybrid models, driving more targeted and focused advertising while also improving the viewer experiences?

Enter unified data management and contextual advertising. By unifying data management and analyzing metadata, brands can strategically place ads that align with the viewer’s interests and intent at that moment — all while staying on the right side of privacy regulations.

While we don’t expect AVOD to surpass SVOD in the near future, it is catching up. And as AVOD continues growing in popularity and contributes a bigger chunk of revenue for streamers than we've seen before, we can expect AVOD and SVOD to coexist alongside pay-TV.

AI acceleration: Use cases and business needs

Though we’ve only scratched the surface of its capabilities, the pace of advancement in generative AI is accelerating rapidly and shaping the next chapter of media and entertainment. Already, AI applications are unlocking new opportunities for greater personalization and targeting. We’re quickly shifting from “wanting” to incorporate AI to “needing” to incorporate the technology to keep up.

While many brands express apprehension around brand safety, the potential of AI to drive efficiencies and enhance creativity is undeniable. As content providers, operators, and advertisers seek ways to navigate the complexities of a fragmented media landscape, generative AI offers a promising solution by streamlining production workflows and enabling the creation of personalized, thematic content.

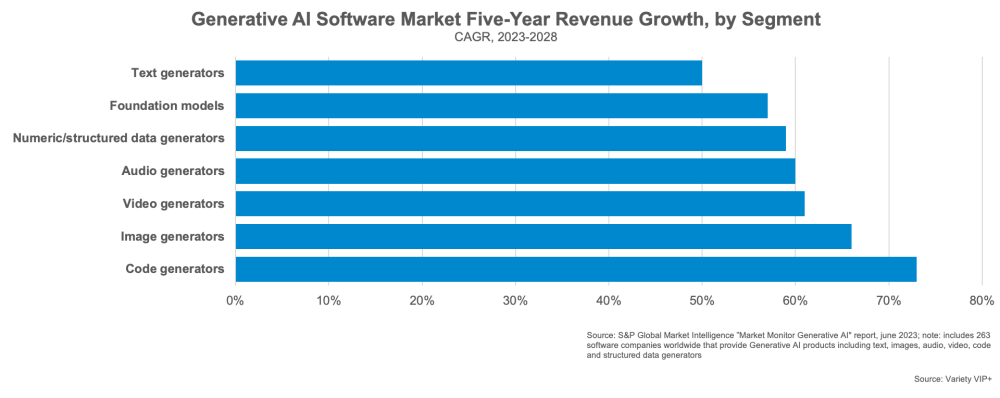

Already we’re seeing generative AI produce synopses and segments with expected growth over the next five years within these top use cases:

-

Audio generators: +60% growth

-

Video generators: +61% growth

-

Image generators: +66% growth

-

Code generators: +73% growth

What does this mean?

Companies that treat AI as table stakes will come out on top in the coming years. From generating clips and metadata to detecting sentiment and creating hyper-specific ad campaigns, AI will only continue to revolutionize how content is conceptualized, produced, and distributed.

To 2030 and beyond…

No matter what the next part of the decade holds, innovation and adaptation will continue to be key to accelerating growth in the media and entertainment landscape. Industry players must continue navigating evolving consumer preferences and embracing technological advancements to overcome challenges and embrace new opportunities to deliver compelling, personalized experiences to audiences.