With a subscription video on demand (SVOD) services market expected to surpass $1.2 billion by the end of this year, it’s no wonder that entertainment and media companies are looking at the Middle East and North Africa (MENA) with increased focus. While the region presents unique opportunities for expansion and greater content monetization, reaching this diverse and often fragmented audience presents distinct challenges.

At our 2024 MENA Monetization Summit in Dubai, industry leaders discussed the innovative strategies they’ve used to thrive in this dynamic market. Read on to learn the drivers behind their success and gain strategic insights for effective content monetization in this rapidly evolving region.

MENA’s streaming and advertising market: highlights to know

Opportunities in MENA are evolving rapidly, driven by a young, tech-savvy population and increasing digital penetration. Consider the following statistics from global analysts Omdia:

- MENA’s SVOD services market generated over $1 billion in revenues in 2023 and is expected to surpass $1.2 billion in 2024.

- Online video advertising in MENA is expected to grow by 67% in revenue by 2028 while online video subscription is expected to grow by 19%.

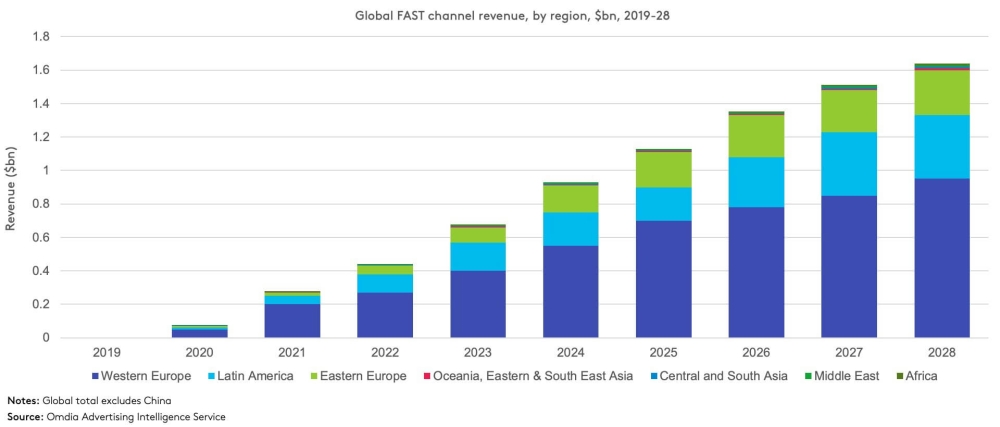

- Already, the Free Ad-Supported TV (FAST) market in MENA has topped $7 million — with the potential to quadruple in the next five years.

- Saudi Arabia sees the highest consumption of YouTube videos globally.

So, how can businesses capitalize on these burgeoning markets? There are a few key considerations when evaluating opportunities for content monetization in MENA:

First, underserved sports content is a great avenue to explore. The popularity of sports such as cricket, rugby, mixed martial arts, and fighting sports in the region opens up significant opportunities to stake out new territory. Since these sports are not as heavily contested by major players, new market entrants can quickly and effectively carve out a niche.

When expanding into MENA, localized content will be particularly important for success. Content tailored to local tastes, cultural norms, and preferences is crucial. This means finding opportunities to produce and broadcast local sports, creating region-specific reality shows, and emphasizing local celebrities and events. Platforms that offer a mix of local productions and international content stand a better chance of engaging the audience.

Similar to findings from other parts of the world, FAST channels are becoming increasingly popular in MENA, providing an alternative to traditional pay-TV. These channels attract large audiences by offering free content supported by advertising. This CTS webinar dives deeper into FAST channel technology.

FAST channel revenues in MENA reached $7.2 million in 2023 and are projected to quadruple in the next 5 years.

Success stories from MENA

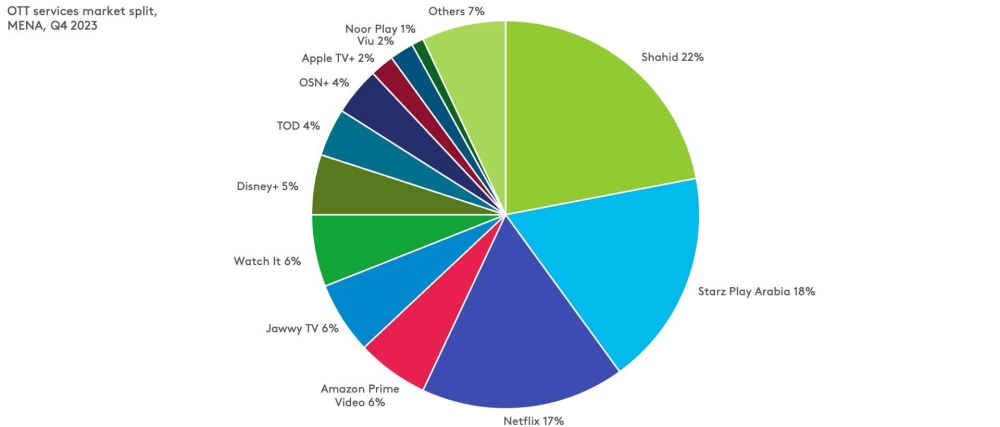

Several companies are successfully navigating the MENA market challenges by leveraging specific strategies and focusing on underserved segments. STARZ PLAY Arabia and Shahid together make up approximately 40% of the total over-the-top (OTT) services market in the region according to Q4 2023 Omdia data.

Shahid and STARZ PLAY lead the MENA streaming video market.

STARZ PLAY: With over 3.5 million subscribers and growing, this highly successful SVOD service has seen tremendous success by focusing on underserved sports and licensed Hollywood content. Here’s the strategy at a glance:

- Securing sports rights including UFC, Cricket World Cup, ICC tournaments

- Enhancing the user experience with sport-specific UI features

Shahid, part of the MBC Group, has established itself as a leading platform in the MENA region by:

- Leveraging its extensive library of premium Arabic content

- Growing both its ad-supported video on demand (AVOD) and SVOD services in tandem but with a heavier emphasis on advertising

Key trends to watch across the region

Shahid, STARZ PLAY, AWS, FreeWheel, and other media companies that have seen considerable success in MENA have tapped into key trends in the region.

- Shifting toward hybrid models: In the Middle East, pay-TV is still important, but online advertising is growing rapidly. Giant entertainment companies such as Netflix and Amazon Prime are exploring ad-supported content. The expected growth in subscriptions combined with the increasing importance of advertising revenue in the region highlight this trend.

- Importance of data and personalization: AI is revolutionizing content monetization in MENA by enhancing personalization and operational efficiency. AI is helping content providers with deeper understanding in user behavior and preferences, allowing for highly targeted and contextual advertising. By using AI to analyze vast amounts of data, companies can predict churn behaviors, personalize content recommendations, and optimize advertising strategies. Employing AI in content production processes, such as automated subtitling in multiple languages, is becoming a cost-effective way to make content more accessible and widen reach.

- Rise of sports: The growing popularity of esports and niche sports presents a lucrative opportunity. The addition of new sports in the Olympic program could lead to increased engagement and monetization.

Looking to grow in MENA? Here’s your roadmap.

To thrive in the competitive MENA market, industry leaders recommend adopting the following strategies:

- Identify and focus on areas underserved by major players, such as specific sports or localized content. This could mean using unique entertainment formats, such as live sports events, to attract audiences, foster brand loyalty, and maximize monetization potential.

- Leverage partnerships and form strategic alliances with local telecom operators, device manufacturers, and opportunities for managed channel origination to boost visibility and distribution opportunities.

- Invest in technology and infrastructure to ensure robust technology and infrastructure to handle high concurrent user traffic. In particular, cloud services and scalable solutions are essential for maintaining a seamless user experience and meeting the expectations of the region’s audiences.

- Enhance fan engagement by leveraging AI and data analytics to create personalized and interactive experiences. It’s a great way to boost real-time engagement during live events, fantasy sports integration, key moments and highlights, and tailored content recommendations.

- Diversify revenue streams and combine subscription services with advertising. Explore opportunities in branded content and sponsorships to maximize revenue potential. The future of content monetization lies in hybrid models that combine subscriptions with advertising. The expected growth in the number of subscriptions and the increasing importance of advertising revenue highlight this trend.

There is immense potential for success in MENA provided that companies can navigate its complexities and leverage its unique opportunities. Understanding local market dynamics and tailoring strategies accordingly will be key to capitalizing on the opportunities at hand.

Looking for a trusted partner to help support your strategies? Contact us today.